operating cash flow ratio negative

A negative cash flow margin is an indicator that the company is losing money. When the ratio is low or negative it could be an indication that the company needs to adjust its operations and start figuring out which activities are sinking its income or whether it needs to expand its market share or increase sales in favor of revamping cash flows.

Cash Flow From Operating Activities Direct And Indirect Method Efm

7 Major Ratios For Analysis Operating Cash Flow Ratio.

. It means that the automaker generates a cash flow of 5 on every 1 of its assets. Cash Flow Impact of Negative NWC. A negative operating cash flow would mean the company could not continue to pay its bills without borrowing money financing activity or raising additional capital investment activity.

500000 100000. If the ratio is less than 10 then the firm is suffering a liquidity crisis and is in danger of default. There is no standard threshold however.

It is a simple basic ratio that tells you how much money youre making from sales. Low cash flow from operations ratio ie. Unlike most balance sheet ratios where there is a certain threshold you want to look for BV 1 for cheapness debt to equity ratio 1 etc there is no exact percentage.

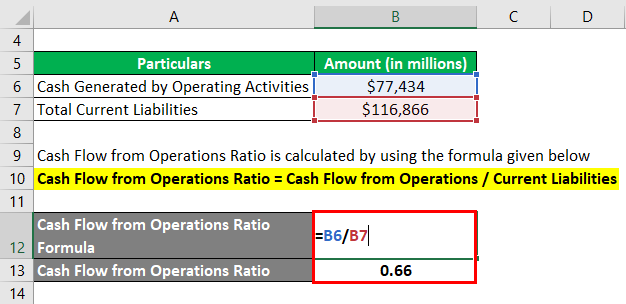

Below 1 indicates that firms current liabilities are not covered by the cash generated from its operations. An operating cash flow ratio of less than one indicates the oppositethe firm has not generated enough cash to cover its current liabilities. As a result Apples free cash flow was 28409 billion for the period 30516 - 2107.

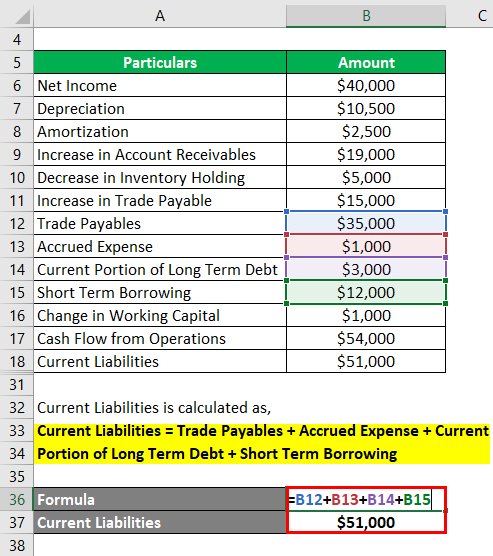

A business generates 500000 of cash flows from operations in its most recent year of operations. Snaps operating cash flow has been negative over the recent years but as the companys revenues are growing immensely cash flows have just tipped to the positive side recently. Formula - Operating cash flow ratio Operating cash flowCurrent liabilities Example Lets assume that your company successfully generated 19 million in a certain year and the liabilities of that corresponding year were 6 million.

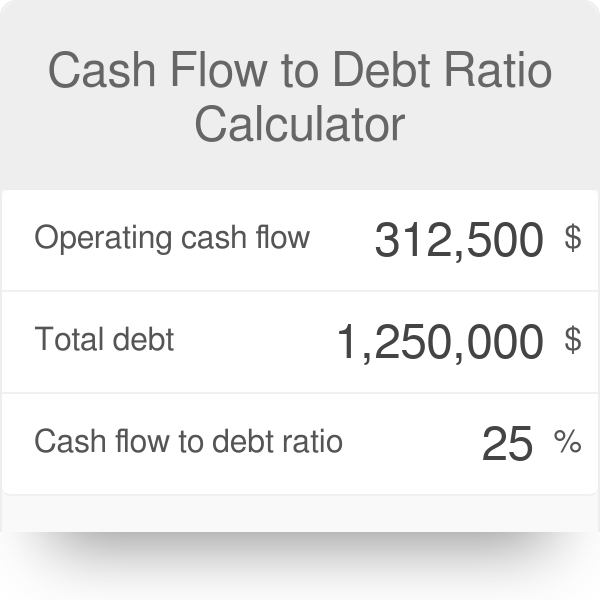

A good operating cash flow margin is typically above 50. Negative operating cash flows can only occur when 1 the companys net income was negative in the first place or 2 when the firm faced a substantial increase in its working capital which was higher than the sum of net income. Its cash flow adequacy ratio is calculated as.

During that time it also paid down 225000 of debt acquired 175000 of fixed assets and paid out 75000 of dividends. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. What does a negative cash flow margin mean.

Dividing -50000 by 500000 to get -01 or -10. When the outflow of cash is higher than the inflow of cash the firm enters a negative financial state. If a company has an operating cash flow margin of below 50 this suggests that the company is not efficiently making sales into cash and instead may have high expenses.

Negative operating cash flow is a situation in which a company or business does not have access to the necessary funds when they are needed to meet expenses. Now lets use our formula. Example of Cash Returns on Asset Ratio.

For this cash flow ratio it shows you how many dollars of cash you get for every dollar of sales. We already know that the companys operating cash flow was 30516 billion. Cash Flow to Sales Ratio.

As cash flows from operations were negative in the first place the company has noted negative free cash flows over the last twelve months before reporting a positive FCF of 5172. Cash returns on assets cash flow from operations Total assets. Youd generally want this to be a higher number.

We can apply the values to our variables and calculate Cash Flow to Sales Ratio. Cash Returns on Asset Ratio 5. Subtract money paid out to buy assets make loans or buy stocks and bonds.

Increase in Operating Current Asset Cash Outflow Use. Since the interest figure is. Using FCF instead of Operating Cash Flow is a variation you can apply to most of the cash flow statement ratios.

Lets consider the example of an automaker with the following financials. 500000 Cash flow from operations 225000 Debt payments 175000 Fixed asset purchases. The general rules of thumb regarding the impact of working capital changes on cash flow are shown below.

All else being equal negative net working capital NWC leads to more free cash flow FCF and a higher intrinsic valuation. In the above example the CFO is. Operating Cash Flow Ratio Cash Flow From Operations CFO Sales.

Cash Flow to Sales 136200000 11600000. So a ratio of 1 above is within the desirable range. In the second scenario above because the operating profit is negative the profit margin percentage will be negative.

Net cash flow from operating activities comes from the statement of cash flows and average current liabilities comes from the balance sheet.

Negative Cash Flow Investments In Companies

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow Statement Analysis Double Entry Bookkeeping

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Financial Statements Understanding Cash Flow Statement Of A Company Getmoneyrich

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow To Debt Ratio Calculator

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Ratio Formula Example Calculation Analysis

Negative Cash Flow Investments In Companies

Operating Cash Flow Ratio Definition And Meaning Capital Com

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash Flow Formula Calculation With Examples

What Is Operating Cash Flow Ocf Definition Meaning Example

Negative Cash Flow Investments In Companies

Summary Of Cash Flow From Operations Abstract